"Health insurance is too expensive?"

"Medicare is too confusing?"

We would like to introduce you to MARC Insurance. We are a family owned and operated Baton Rouge insurance agency specializing in Health Insurance and Medicare. There is never a charge for our services.

MARC Insurance is the Dave Ramsey appointed Health Insurance Endorsed Local Provider for our region. We follow Dave Ramsey's principles emphasizing "The Heart of a Teacher". A "teacher" takes more time, effort and caring to guide and educate the client. Learn more about ELP's here

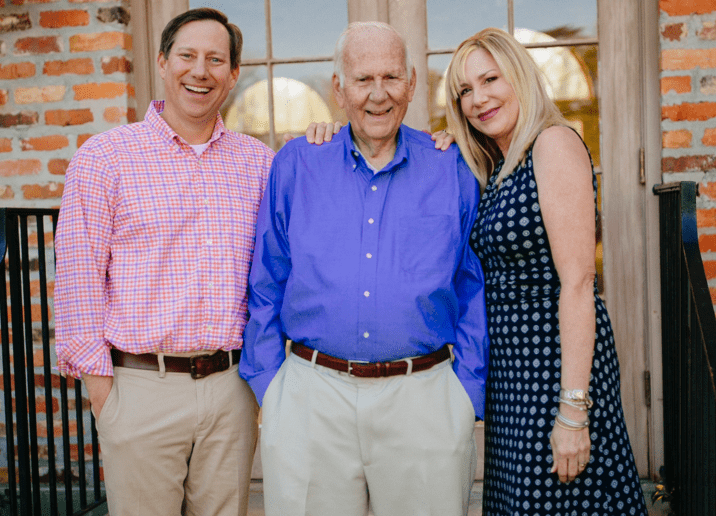

MARC Insurance is owned by the Thomas family with Roger, Alan and Christina serving as licensed and certified agents.

MARC Insurance is headquartered in Baton Rouge serving the State of Louisiana for over 15 years.